Compliance… some companies see it as a necessary evil, some align with the benefits of it for their industry. Compliance is crucial across all industries as it ensures that companies are following laws and regulations that are designed to protect consumers, employees, and stakeholders. It is essential for companies to operate legally and ethically.

In relation to your technology, compliance becomes even more important given the sensitive information that is stored and processed.

Unfortunately, compliance can be a complex and challenging task for companies, particularly for those that are not familiar with the specific regulations that apply to them. It can be difficult to stay on top of constantly changing regulations and to ensure that all employees are following the necessary procedures.

Fortunately, there are options for you to easily gain compliance. There are ways to get IT support and assistance with various aspects of compliance, such as ensuring that data is stored securely and that all software and systems are up-to-date. You can reduce the risk of non-compliance and can focus on your core business activities.

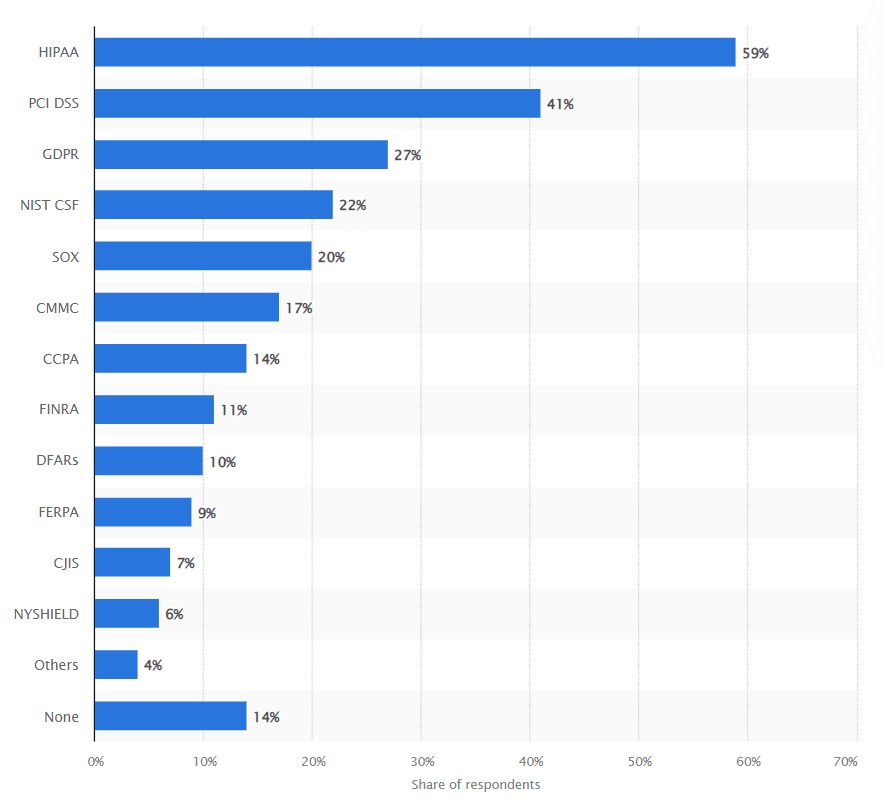

Here is an insightful chart showing the percent of MSPs who cover different compliance requirements for their clients:

This post is setup more as a guide than a blog post, so please link right to the section that aligns with you:

Accounting Industry Compliance

Accounting firms are subject to various technology compliance laws that aim to protect sensitive client information and ensure that financial data is handled in an accurate and secure manner.

This may be common knowledge, but to make sure we’re on a level playing field, some of the key technology compliance laws for accounting firms include:

- Sarbanes-Oxley Act (SOX): This law requires companies to establish internal controls and procedures to ensure the accuracy and reliability of financial reporting. Accounting firms must comply with SOX when handling client financial data, and must implement strict access controls and security measures to protect this information.

- Payment Card Industry Data Security Standard (PCI DSS): This law applies to accounting firms that process, store or transmit credit card information on behalf of clients. PCI DSS requires companies to implement strong security measures, such as encrypting data, regularly updating software, and conducting regular security assessments.

- Health Insurance Portability and Accountability Act (HIPAA): This law applies to accounting firms that handle medical information for clients. HIPAA requires companies to implement strict security measures to protect client health information, such as encrypting data and limiting access to authorized personnel only.

- FTC Safeguards Law: Replacing the Gramm Leach Bliley Act (GLBA) in June ’23, this is a drastic update to the original law. Accounting firms may now be included in this law as the FTC has drastically expanded the definition of a “financial institution”. By focusing on “the types of activities” a business engages in, the rule captures businesses “significantly engaged in financial activities.” This includes accounting firms handling taxes as well as other firms.

The new FTC Safeguard law expands upon the requirements of the GLBA by including 9 specific requirements for “financial institutions” to protect consumer data.

The 9 requirements cover areas such as risk assessment, data encryption, employee training, and incident response planning.

Compliance IT Challenges

In relation to technology compliance for accounting firms, the following are some of the top IT challenges:

- Data Security: Ensuring that client financial and personal information is protected against unauthorized access and data breaches is a major challenge.

- Software and System Updates: Keeping software and systems up-to-date with the latest security patches and versions can be difficult, especially if the accounting firm has a large number of systems.

- Access Controls: Implementing strict access controls to ensure that client information is only accessible by authorized personnel can be a challenge.

- Data Backup and Recovery: Ensuring that client data is backed up regularly and can be recovered in the event of a disaster is a critical IT challenge.

- Compliance Monitoring: Keeping up-to-date with the latest regulations and standards, and ensuring that the accounting firm is in compliance with all relevant laws, can be difficult.

- Employee Training: Ensuring that all employees are trained on the latest security policies and procedures, and are aware of their obligations when it comes to handling client information, is a challenge.

- IT Resource Constraints: With limited IT resources, accounting firms may struggle to implement and maintain the necessary policies and procedures to ensure compliance.

- Cost: Implementing the necessary technologies and processes to ensure compliance can be expensive, especially for small accounting firms.

Technology compliance for accounting firms requires a combination of technical expertise and attention to detail that is sometimes not an option internally.

Internal vs External IT Compliance Coverage

Some accounting firms handle the IT side of compliance internally by establishing an in-house IT department. This approach has both advantages and disadvantages.

Advantages:

- Control: By handling IT compliance internally, accounting firms have more control over the processes and technologies used to ensure compliance.

- Customization: Accounting firms can tailor their compliance processes to their specific needs, which can be especially important for firms that operate in niche industries. This may turn into a disadvantage though, when it increases the work load as compared with outsourcing compliance.

Disadvantages:

- Limited IT resources: Small accounting firms may struggle to allocate the necessary IT resources to ensure compliance, especially if they have limited budgets.

- Lack of expertise: Handling IT compliance requires technical expertise and knowledge of the latest regulations and standards. Accounting firms that lack this expertise may struggle to ensure compliance.

- Time constraints: Ensuring compliance can be time-consuming, especially if accounting firms have multiple clients and a large volume of client data to manage.

While some accounting firms choose to handle the IT side of compliance internally, this approach can be challenging. Small accounting firms, in particular, may struggle to allocate the necessary IT resources and may lack the expertise required to ensure compliance. There are many challenges that can be overcome by outsourcing your IT. However, larger accounting firms with well-established IT departments may be able to handle compliance internally, provided that they have the necessary resources and expertise.

Conquering Compliance with an MSP

An MSP can help accounting firms overcome the main IT challenges in the following ways:

- Data Security: An MSP can provide the necessary technical expertise and resources to implement strong data security measures, such as firewalls, encryption, and intrusion detection systems.

- Software and System Updates: An MSP can monitor software and systems for updates and can ensure that they are installed in a timely manner to keep client information protected.

- Access Controls: An MSP can implement strict access controls and can ensure that only authorized personnel have access to client information.

- Data Backup and Recovery: An MSP can provide regular data backup and can ensure that client data can be recovered quickly in the event of a disaster.

- Compliance Monitoring: An MSP can monitor the latest regulations and standards, and can advise accounting firms on how to comply with these laws.

- Employee Training: An MSP can provide training to employees on the latest security policies and procedures and can help accounting firms stay up-to-date with the latest best practices.

- IT Resource Constraints: An MSP can provide additional IT resources and can help accounting firms overcome limitations in their internal IT departments.

- Cost: An MSP can provide cost-effective solutions and can help accounting firms save money on IT costs, especially for small accounting firms that do not have the budget to invest in expensive IT solutions.

Overall, with all the above advantages it is not hard to see why many accounting firms choose to partner with an MSP when it comes time for IT compliance coverage. It is important though to make sure you’re partnering with the right MSP: How to Find the Best MSP for your Company

Financial Industry Compliance

Compliance is a critical aspect of operations for financial companies. Financial institutions are responsible for handling large amounts of sensitive information, including personal financial data and confidential business information. Ensuring the security of this data is essential to maintaining trust with clients and protecting the reputation of the financial institution.

Additionally, non-compliance with relevant regulations can result in significant financial penalties and reputational damage. Moreover, compliance also helps financial institutions maintain their competitive advantage and stay ahead of potential cyber threats. By implementing robust security measures and regularly reviewing their processes, financial institutions can detect and prevent security breaches and minimize the risk of financial loss.

You may be aware of each of these laws based on your experience, but to make sure we’re on the same page, the top compliance laws that financial companies must adhere to include:

- Payment Card Industry Data Security Standard (PCI DSS): This standard is designed to protect credit card transactions and sensitive information from theft.

- Federal Trade Commission Safeguard (FTC Safeguard) law: This law requires financial institutions to implement specific security measures to protect consumer data.

- The Sarbanes-Oxley Act (SOX): This law requires public companies to maintain the accuracy and integrity of their financial information.

- Health Insurance Portability and Accountability Act (HIPAA): This law sets standards for protecting the privacy and security of personal health information.

- The Fair Credit Reporting Act (FCRA): This law regulates the collection, dissemination, and use of consumer credit information.

- The FTC Safeguard Law, set to replace the Gramm Leach Bliley Act (GLBA) in June 2023, represents a significant update to the original legislation. The law has been expanded by the FTC as it focuses on the types of activities a business engages in rather than the industry it operates in.

The FTC Safeguard Law requires “financial institutions” to comply with 9 specific requirements to protect consumer data. These requirements include risk assessments, encryption of data, employee training, and incident response planning. By adhering to these requirements, financial institutions are expected to maintain the security and confidentiality of consumer data.

IT Compliance Challenges

Financial companies face several IT challenges in adhering to compliance regulations, including:

- Data security: Financial institutions handle a large amount of sensitive information, making it a target for cyber attacks. Ensuring the security of this data is a major challenge.

- Data privacy: Protecting consumer data is a major concern, and ensuring the privacy of this information can be challenging.

- System updates and maintenance: Keeping software and systems up-to-date and secure is a constant challenge for financial institutions.

- Incident response planning: Quickly and effectively responding to security incidents is essential, but planning and preparation can be difficult.

- Employee training: Ensuring employees are aware of security policies and are properly trained is essential, but can be challenging to implement.

- Keeping up-to-date with changing regulations: Financial institutions must stay up-to-date with changing regulations and requirements, which can be time-consuming and difficult to manage.

- Integration of systems: Integrating multiple systems and ensuring they are compliant can be challenging for financial institutions.

- Ensuring vendor compliance: Financial institutions rely on many third-party vendors, and ensuring they are compliant with regulations can be a significant challenge.

These challenges require significant resources and expertise to overcome.

Compliance Options

Financial companies have several options for handling IT compliance internally, including:

- In-house IT teams: Some financial companies have dedicated IT teams responsible for managing compliance, including implementing and maintaining security measures and training employees on security policies.

- Compliance departments: Some financial companies have separate compliance departments responsible for ensuring that all aspects of the business are compliant with regulations. These departments may work closely with the IT team to ensure compliance in the technology side of things.

- Outsourcing to third-party vendors: Some financial companies outsource compliance responsibilities to third-party vendors, such as Managed Service Providers (MSPs), who have expertise in compliance and security.

Regardless of the approach, financial companies must invest in resources and personnel to ensure they are compliant with regulations. This can include hiring and training IT personnel, conducting regular security assessments, and implementing security measures to protect sensitive information.

Easing the Compliance Challenges with an MSP

Luckily, the strong option for overcoming the challenges is working with an MSP. An MSP can help financial companies overcome the following IT compliance challenges:

- Lack of expertise: MSPs have a team of certified and experienced professionals who can help financial companies navigate the complex compliance landscape and ensure that their systems and processes meet the requirements.

- Time constraints: MSPs can provide ongoing monitoring and management of compliance-related tasks, freeing up the financial company’s in-house IT team to focus on other important initiatives.

- Keeping up with changing regulations: MSPs are familiar with the latest regulations and can provide guidance on how to stay compliant with changing laws and requirements.

- Implementing and maintaining security measures: MSPs can provide expertise in implementing and maintaining security measures such as firewalls, intrusion detection systems, and encryption technologies.

- Training employees: MSPs can provide training to financial company employees on security policies and procedures, helping to ensure that everyone understands the importance of compliance.

- Regular security assessments: MSPs can perform regular security assessments and provide recommendations on how to improve security and comply with regulations.

- Incident response planning: MSPs can provide guidance on incident response planning and help financial companies prepare for potential security breaches or other incidents.

- Cost: MSPs can provide cost-effective compliance solutions for financial companies, helping them meet their compliance requirements without breaking the bank.

Working with an MSP is a great way to help financial companies overcome the challenges of IT compliance. With an experienced team of certified professionals at your side, you’re sure to have all the resources needed for successful IT compliance management.

It is important to make sure you’re partnering with the right MSP: How to Find the Best MSP for your Company

Healthcare Industry Compliance

Healthcare companies have a crucial role in protecting the sensitive personal and medical information of their patients. Compliance is therefore of the utmost importance for these companies, as non-compliance can result in hefty fines, damage to reputation, and loss of trust from patients.

Adherence to these laws and regulations is essential for ensuring the confidentiality and privacy of patient information, maintaining the trust of patients and stakeholders, and protecting the reputation of the healthcare company. Unfortunately, 40% of healthcare companies reported they haven’t evaluated their security measures in the last three years. Moreover, with the increasing use of technology in healthcare, compliance has become even more crucial, as the rise of cyber attacks and data breaches has put patient information at risk.

You are probably well aware of the laws governing your industry, but to make sure we’re on the same page, the top laws you need to comply with include:

- The Health Insurance Portability and Accountability Act (HIPAA): This law sets standards for protecting the privacy and security of patients’ health information.

- The 21st Century Cures Act: This law requires healthcare organizations to implement robust cybersecurity programs to protect patient data.

- The General Data Protection Regulation (GDPR): This law applies to healthcare companies that handle the personal data of European Union (EU) citizens.

- The Cybersecurity Information Sharing Act (CISA): This law requires healthcare organizations to share information about cyber threats and incidents with the government and other industry partners.

- The Federal Drug Administration (FDA): The FDA sets guidelines for the secure handling and protection of electronic protected health information (ePHI) used in medical devices.

These laws and regulations require healthcare organizations to implement strong technology systems and processes to ensure the privacy and security of patient data.

IT Compliance Challenges

Healthcare organizations face several IT challenges in their quest to comply with the various technology-related laws and regulations, including:

- Data security: Protecting patient data from cyber threats such as hacking, phishing, and malware attacks.

- Data privacy: Ensuring that patient data is protected and kept confidential in accordance with HIPAA and other privacy laws.

- Data storage: Storing patient data in a secure and compliant manner, including backing up and recovering data as needed.

- Data integration: Integrating patient data from multiple sources into a single, unified system.

- Technical infrastructure: Maintaining an up-to-date and secure technical infrastructure, including hardware, software, and networks.

- Employee training: Ensuring that all employees understand and follow best practices for protecting patient data.

- Incident response: Having a plan in place for responding to and mitigating data breaches or other cyber threats.

- Compliance monitoring: Continuously monitoring and maintaining compliance with all relevant technology-related laws and regulations.

These IT challenges require healthcare organizations to have the right technology systems and processes in place to ensure the privacy and security of patient data.

Internal vs External IT Compliance Coverage

Healthcare companies have several options to ensure compliance with technology-related laws and regulations and overcome the IT challenges they face. These options can be broadly classified as internal and external options.

Internal Options:

- In-house IT team: Healthcare companies can have a dedicated IT team to manage their technology and ensure compliance.

- Training and education: Healthcare companies can provide training and education to their employees on data privacy and security best practices, including the use of secure passwords, secure data storage, and privacy policies.

External Options:

- Managed Service Providers (MSPs): An MSP can provide IT support, manage data security and privacy, and help ensure compliance with relevant laws and regulations.

- Consultants: Healthcare companies can hire consultants to provide expert advice on data security, privacy, and compliance.

- Third-party audits: Healthcare companies can use third-party auditors to assess their data security, privacy, and compliance practices and make recommendations for improvement.

Many small business challenges can be overcome by outsourcing your IT.

Ease the Compliance Burden with an MSP

Managed Service Providers (MSPs) can help healthcare companies overcome the following challenges related to technology compliance:

- Data security: An MSP can provide secure data storage solutions and implement best practices for protecting patient data.

- Regulatory compliance: An MSP can ensure that a healthcare company’s technology complies with relevant laws and regulations, such as HIPAA.

- Data backup and recovery: An MSP can implement data backup and recovery systems to protect against data loss in case of a disaster or cyberattack.

- Network infrastructure: An MSP can design and maintain a secure network infrastructure to protect against unauthorized access and data breaches.

- Cybersecurity: An MSP can provide cybersecurity solutions to protect against cyberattacks, such as antivirus software, firewalls, and intrusion detection systems.

- Software updates: An MSP can manage software updates to ensure that all systems are up-to-date and secure.

- Employee training: An MSP can provide training for employees on best practices for data security and privacy.

- Incident response planning: An MSP can help healthcare companies create and implement incident response plans to address data breaches and other cybersecurity incidents.

MSPs allow healthcare companies to ease the burden associated with ensuring technology compliance while protecting patient data from unauthorized access or cyberattacks.

It is important to make sure you’re partnering with the right MSP: How to Find the Best MSP for your Company

Legal Industry Compliance

Law firms handle sensitive and confidential information on a daily basis, making them vulnerable to cyber threats and data breaches. To protect the privacy of client data and maintain the trust of their clients, law firms must comply with a range of technology compliance laws. In addition, there has been a surge of cloud use by law firms, with about 40% use in 2022, up from just 3% in 2020, highlighting the need for stricter cybersecurity compliance.

You’re probably aware of all of these plus potentially more compliance areas, but to make sure we’re on the same page, some of the key technology compliance laws for legal firms include:

- Health Insurance Portability and Accountability Act (HIPAA): This federal law governs the privacy and security of protected health information (PHI) and applies to legal firms that handle PHI in the course of providing legal services.

- Fair Credit Reporting Act (FCRA): This federal law governs the collection, use, and dissemination of consumer credit information and applies to legal firms that use credit reports in the course of their work.

- Sarbanes-Oxley Act (SOX): This federal law governs financial reporting and internal controls for public companies and applies to legal firms that provide services to public companies.

- California Consumer Privacy Act (CCPA): This state law governs the privacy rights of consumers in California and applies to legal firms that do business in California.

These laws cover a variety of areas, including financial information, health information, consumer credit information, financial reporting, and personal data.

Legal firms must stay up-to-date with the latest regulations and standards and must implement appropriate security measures to ensure compliance.

IT Compliance Challenges

The following are some of the top IT challenges faced by legal firms when it comes to technology compliance:

- Keeping up-to-date with changing regulations and standards: Legal firms must stay informed of the latest compliance laws and regulations, and implement any necessary changes to their systems and processes to ensure continued compliance.

- Protecting confidential client information: Legal firms handle sensitive and confidential client information and must implement robust security measures to protect this data from cyber threats and data breaches.

- Implementing security controls: Legal firms must implement appropriate security controls to protect client data and comply with relevant regulations, such as encryption, firewalls, and multi-factor authentication.

- Conducting regular security assessments: To ensure ongoing compliance and to identify any potential vulnerabilities in their systems, legal firms must regularly perform security assessments and implement any necessary remediation actions.

- Maintaining data privacy: Legal firms must comply with regulations related to data privacy and must take steps to protect the privacy of client data, such as implementing data masking and de-identification techniques.

- Managing client data across multiple locations and devices: Legal firms must ensure that client data is secure and accessible across all locations and devices, including remote workers, laptops, and mobile devices.

- Ensuring compliance with global regulations: Legal firms that serve clients in multiple countries must comply with different regulations in each country, which can be challenging and time-consuming.

- Balancing security and accessibility: Legal firms must strike a balance between ensuring the security of client data and ensuring that the data is accessible to authorized users in a timely manner.

To overcome these challenges, legal firms must adopt a proactive approach to compliance, implement appropriate security measures, and stay up-to-date with the latest regulations and standards.

Internal vs External IT Compliance Coverage

Many legal firms handle the IT side of compliance internally by assigning responsibility to one or more individuals within the organization, who are responsible for ensuring that the firm is in compliance with relevant regulations and standards. These individuals typically have technical knowledge and expertise in the area of IT security and are able to implement the necessary measures to ensure compliance.

While handling the IT side of compliance internally can be challenging, it also allows legal firms to have more control over the compliance process and to tailor their security measures to meet their specific needs. However, it also requires significant investment in terms of time, resources, and expertise.

Some legal firms may find it beneficial to use an external Managed Service Provider (MSP) to help them with the IT side of compliance, especially if they do not have the necessary technical expertise in-house.

Tackling Compliance with an MSP

An Managed Service Provider (MSP) can help a legal firm overcome the top IT compliance challenges:

- Keeping up-to-date with changing regulations and standards: An MSP can provide regular updates on changes to regulations and standards and assist the legal firm in implementing any necessary changes to ensure continued compliance.

- Protecting confidential client information: An MSP can implement robust security measures to protect client data from cyber threats and data breaches, such as encryption, firewalls, and multi-factor authentication.

- Implementing security controls: An MSP can help a legal firm implement the appropriate security controls to ensure compliance and protect client data.

- Conducting regular security assessments: An MSP can regularly perform security assessments to identify potential vulnerabilities in the legal firm’s systems and implement any necessary remediation actions.

- Maintaining data privacy: An MSP can assist a legal firm in complying with regulations related to data privacy and in implementing data masking and de-identification techniques.

- Managing client data across multiple locations and devices: An MSP can help a legal firm manage client data securely and with accessibility across all locations and devices, including remote workers, laptops, and mobile devices.

- Ensuring compliance with global regulations: An MSP with global experience can assist a legal firm in complying with regulations in different countries and ensure that client data is protected in accordance with the relevant regulations.

- Balancing security and accessibility: An MSP can help a legal firm strike a balance between ensuring the security of client data and ensuring that the data is accessible to authorized users in a timely manner.

By partnering with an MSP, legal firms can benefit from the MSP’s expertise and experience in the area of IT security and compliance, freeing up internal resources to focus on other areas of their business.

It is important to make sure you’re partnering with the right MSP: How to Find the Best MSP for your Company

Follow Us!

Recent Comments